Understanding the Net Worth Top 2 Percent reveals how the wealthiest individuals accumulate and grow their fortunes. From smart investments and real estate holdings to high-income careers and strategic financial planning, these elites set themselves apart. Exploring their asset management, wealth strategies, and financial habits provides valuable insights for anyone aiming to boost their own net worth.

Understanding Top Percent Net Worth

Net worth percentiles help you understand where your wealth stands compared to the wider economy. Net worth measures all your assets like cash, investments, property, and businesses minus your liabilities, such as loans and debts.

Examining percentiles like the top 1, 2, 3, 5, and 15 percentiles highlights wealth concentration, financial habits of the wealthy, and strategies you can adopt to grow your own net worth. Understanding these thresholds can guide investment decisions, retirement planning, and long-term wealth growth.

What Does “Top 1 Percent” Net Worth Mean?

Being in the top 1 percent means having more wealth than 99 percent of households.

Key points:

- Minimum net worth to enter the top 1 percent is roughly $12 million or more.

- Includes assets such as stocks, retirement accounts, real estate, business equity, minus any debts.

- The top 1 percent holds a significant share of total national wealth, influencing markets and policies.

Characteristics of the Top 1 Percent:

- Diverse investment portfolios including stocks, bonds, and private equity

- Strategic tax planning and professional wealth management

- Early investment habits and long-term financial planning

Why it matters:

This level defines the financial elite, offering economic influence and a platform for wealth growth across generations.

What Does “Top 2 Percent” Net Worth Mean?

The top 2 percent represents households just below the ultra-wealthy 1 percent.

Key points:

- Net worth threshold for the top 2 percent is approximately $8.5 million or higher.

- Individuals here typically have strong liquidity, investment assets, and real estate holdings.

- These households enjoy high financial flexibility and early retirement potential.

Net Worth Perspective Table:

| Percentile Group | Approx. Minimum Net Worth | Wealth Tier |

| Top 1% | $12 M+ | Ultra-Wealthy |

| Top 2% | $8.5 M+ | Very High Net Worth |

| Top 3% | $5–7 M+ | High Net Worth |

| Top 5% | $3.5 M+ | Affluent |

| Top 15% | $850 K+ | Upper-Middle Wealth |

Key Strategies:

- Portfolio diversification across assets and sectors

- Professional financial advice and estate planning

- Consistent investment contributions and disciplined savings

What Does “Top 3 Percent” Net Worth Mean?

The top 3 percent includes households with net worth significantly higher than most, typically $5 million to $8 million.

Characteristics:

- Strong presence in investment markets, property ownership, and business equity

- Advanced retirement planning and asset protection strategies

- Access to tools and resources for optimizing wealth growth

Financial Habits:

- Balanced risk-taking in investment portfolios

- Maintaining emergency funds while aggressively growing investments

- Strategic use of tax-advantaged accounts

What Does “Top 5 Percent” Net Worth Mean?

Ranking in the top 5 percent signals notable financial achievement and security.

Threshold:

- Minimum net worth around $3.5 million

Key Points:

- This tier includes successful professionals, entrepreneurs, and investors

- Provides strong economic stability and long-term wealth potential

Financial Strategies:

- Consistent investing in diversified portfolios

- Smart use of debt for leverage in property and business

- Planning for generational wealth and retirement security

What Does “Top 15 Percent” Net Worth Mean?

The top 15 percent encompasses households well above the median, usually with a net worth of $850,000 or more.

Key Features:

- Many own property equity, retirement accounts, and emergency funds

- Less concentrated than top 5 percent but still financially secure

- Often includes upper-middle-class professionals and growing entrepreneurs

Why it matters:

- Achieving this percentile is a realistic goal for many through disciplined saving, investing, and debt management

- Provides access to better financial tools, credit, and investment opportunities

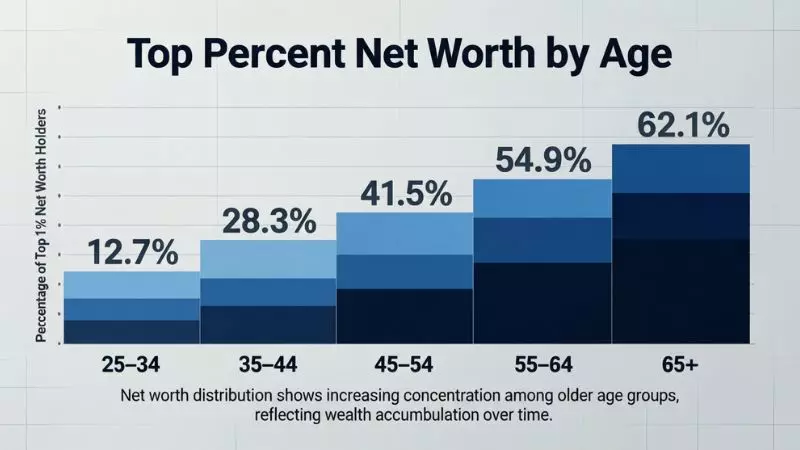

Top Percent Net Worth by Age

Understanding net worth by age helps you see how wealth typically grows over a lifetime and how the ultra-wealthy build assets at different stages. Net worth includes savings, investments, real estate, business equity, and other assets minus debts. Examining the top 1, 2, and 3 percent net worth across age groups shows patterns in income, investment strategies, and financial habits, giving valuable insights for planning and wealth growth.

Top 1 Percent Net Worth by Age

The top 1 percent achieves extraordinary wealth at various life stages.

Typical Net Worth by Age:

- Under 35 years: $1.5 M–$3 M – often from entrepreneurship, stock options, or early investments

- 35–44 years: $3 M–$7 M – wealth grows via investments, real estate, and business expansion

- 45–54 years: $7 M–$15 M – peak earning years, diversified asset portfolio, retirement planning

- 55–64 years: $15 M–$25 M – focus on preserving wealth, tax optimization, estate planning

- 65+ years: $25 M+ – legacy planning, generational wealth transfer, and passive income

Key Insights:

- Early wealth accumulation often comes from entrepreneurship or high-income careers

- Diversification into real estate, stocks, and retirement accounts is critical

- Financial planning and asset protection strategies become more important with age

Top 2 Percent Net Worth by Age

The top 2 percent represents a very high net worth but slightly below the ultra-wealthy 1 percent.

Age-Based Net Worth Estimates:

- Under 35 years: $1 M–$2 M – early career professionals or young entrepreneurs

- 35–44 years: $2 M–$5 M – growing investments and real estate equity

- 45–54 years: $5 M–$10 M – peak earning years, investment portfolios mature

- 55–64 years: $10 M–$15 M – wealth preservation and retirement planning

- 65+ years: $15 M–$20 M – passive income and strategic asset transfer

Key Financial Habits:

- Consistent investing in diversified portfolios

- Real estate and retirement accounts play a significant role

- Strategic debt and tax planning

Top 3 Percent Net Worth by Age

The top 3 percent captures households with significant wealth, often high-net-worth individuals who have achieved strong financial growth.

Age-Based Net Worth Overview:

| Age Group | Approx. Net Worth | Wealth Characteristics |

| Under 35 | $900K–$1.5M | Early investments, startup equity, savings habits |

| 35–44 | $1.5M–$4M | Real estate, career growth, diversified portfolios |

| 45–54 | $4M–$7M | Peak earning, strategic investment, retirement accounts |

| 55–64 | $7M–$10M | Wealth protection, tax planning, estate prep |

| 65+ | $10M+ | Passive income, legacy planning, generational wealth |

Key Takeaways:

- Wealth grows steadily with age due to investments, career growth, and business ownership

- Top 3 percent households often focus on both growth and preservation

- Long-term planning is essential to maintain and

Top Percent Net Worth by Region

Net worth can vary significantly across countries due to differences in income, cost of living, taxation, and investment opportunities. Understanding the top 2 percent net worth by region provides insight into global wealth distribution, financial strategies, and benchmarks for high-net-worth individuals. Comparing the US, Canada, and the UK highlights how economic environments shape asset accumulation and wealth growth.

Net Worth Top 2 Percent in the US

In the United States, the top 2 percent hold a significant portion of national wealth.

Key Points:

- Minimum net worth to enter the top 2 percent: approximately $8.5 million

- Assets include stocks, real estate, retirement funds, and business equity

- Wealth is concentrated in major urban centers like New York, Los Angeles, and San Francisco

Wealth Patterns:

- High-income careers and entrepreneurship drive early wealth accumulation

- Diversification into equities and real estate is common

- Active wealth management and tax planning are crucial for long-term growth

Net Worth Top 2 Percent in Canada

Canada’s top 2 percent net worth reflects its economic structure and social system.

Key Points:

- Minimum net worth for top 2 percent: around CAD 5–6 million

- Significant assets include primary residences, investment portfolios, and registered retirement accounts

- Wealth is often concentrated in Toronto, Vancouver, and Calgary

Financial Habits:

- Strong emphasis on real estate equity, especially urban properties

- Investments in stock markets and mutual funds are common

- Retirement planning and tax-efficient strategies support wealth growth

Net Worth Top 2 Percent in the UK

In the United Kingdom, achieving top 2 percent net worth reflects both financial strategy and asset accumulation.

Key Points:

- Minimum net worth for top 2 percent: approximately £5 million

- Assets include property, pensions, investments, and business holdings

- Wealth is concentrated in London, the South East, and some high-income regional areas

Wealth Strategies:

- Investment in property and diversified portfolios

- Strong pension planning and use of tax-efficient accounts like ISAs

- Entrepreneurship and business ownership play a key role

Regional Net Worth Comparison Table:

| Country | Approx. Net Worth for Top 2% | Key Assets | Wealth Concentration |

| US | $8.5M+ | Stocks, real estate, businesses | NY, LA, SF |

| Canada | CAD 5–6M+ | Real estate, investments, retirement accounts | Toronto, Vancouver, Calgary |

| UK | £5M+ | Property, pensions, investments, businesses | London, South East |

Top Percent Net Worth Statistics

Understanding the statistics of top percentile net worth gives clarity on wealth distribution and financial positioning. By analyzing average, median, and minimum net worth of the top 2 percent, you can understand the financial benchmarks, asset allocation, and economic influence of this elite group. These insights are valuable for personal wealth planning, investment strategies, and setting realistic financial goals.

Average Net Worth of the Top 2 Percent

The average net worth of the top 2 percent highlights how wealth is concentrated at the high end of the spectrum.

Key Points:

- Average net worth is approximately $12 million in the US.

- Assets include stocks, real estate, retirement accounts, and business holdings.

- Average figures show that the wealthiest not only have high incomes but also significant investments and passive income streams.

Wealth Insights:

- Average net worth is influenced by ultra-high-net-worth households within the top 2 percent

- Wealth growth often accelerates after age 40 due to career, investments, and property accumulation

- Professional wealth management and tax planning amplify net worth

Median Net Worth of the Top 2 Percent

The median net worth provides a more realistic view of typical households in this group.

Key Points:

- Median net worth for top 2 percent households is roughly $9 million.

- Less skewed by ultra-rich outliers compared to average net worth.

- Reflects the financial situation of a “typical” top 2 percent household.

Financial Habits:

- Strategic investment in real estate, stocks, and retirement funds

- Maintaining liquidity for emergencies and opportunities

- Focus on long-term wealth preservation

Minimum Net Worth of the Top 2 Percent

The minimum net worth defines the entry threshold for this elite group.

Key Points:

- Minimum net worth to qualify as top 2 percent is around $8.5 million.

- Households at this level may be high-income professionals, entrepreneurs, or investors.

- Achieving this level often requires disciplined savings, smart investments, and leveraging assets strategically.

Strategies for Entry:

- Early career investment in stocks and retirement accounts

- Real estate equity accumulation

- Diversification and risk management in investment portfolios

Household Net Worth in the Top 2 Percent

Understanding household net worth helps contextualize how wealth is shared within families.

Key Points:

- Household net worth includes combined assets of spouses or partners minus debts.

- Many top 2 percent households own multiple properties, investment portfolios, and business stakes.

- Wealth distribution within households is influenced by inheritance, career earnings, and financial planning.

Household Net Worth Table:

| Statistic | Approximate Amount | Notes |

| Average Net Worth | $12M+ | Includes ultra-rich outliers |

| Median Net Worth | $9M+ | Represents typical top 2% households |

| Minimum Net Worth | $8.5M | Entry threshold for top 2% |

| Household Asset Allocation | 60% investments, 30% real estate, 10% other assets | Typical portfolio distribution |

Global Perspective

Examining net worth on a global scale helps us understand wealth distribution, economic power, and financial inequality worldwide. Comparing the top 1 and 2 percent globally reveals the differences in asset accumulation, investment strategies, and lifestyle across countries. For anyone studying wealth trends, this perspective provides actionable insights into global financial planning, investment opportunities, and high-net-worth benchmarks.

Net Worth of the Top 1 Percent in the World

The top 1 percent globally represents the wealthiest individuals who control a significant portion of total global wealth.

Key Insights:

- Minimum net worth for the top 1 percent worldwide is estimated at $11 million.

- Assets include international investments, property, luxury goods, and business equity.

- Wealth is heavily concentrated in North America, Europe, and parts of Asia.

Global Patterns:

- Individuals often diversify across multiple countries and currencies

- Investment strategies include stocks, bonds, real estate, private equity, and alternative assets

- Tax planning and asset protection are critical at this level

Characteristics of Top 1 Percent Globally:

- Ultra-high-net-worth portfolios with high liquidity and international diversification

- Access to elite financial services and private investment opportunities

- Focused on long-term wealth preservation and legacy planning

Net Worth of the Top 2 Percent in the World

The top 2 percent globally includes high-net-worth individuals just below the ultra-rich 1 percent but still significantly above the global median.

Key Insights:

- Minimum net worth for the top 2 percent worldwide is approximately $8.5 million.

- Individuals typically have a mix of real estate, financial investments, retirement accounts, and business holdings.

- Wealth is more evenly distributed than the top 1 percent but still concentrated in developed regions.

Global Wealth Distribution Table:

| Percentile | Approx. Minimum Net Worth | Key Assets | Regional Concentration |

| Top 1% | $11M+ | International investments, property, business equity | North America, Europe, Asia |

| Top 2% | $8.5M+ | Stocks, real estate, retirement accounts, business holdings | North America, Europe, Asia |

Financial Habits of Top 2 Percent Globally:

- Focus on diversified portfolios to reduce risk

- Investment in real estate and global equities

- Strategic planning for retirement, taxes, and wealth transfer

Final Words

Understanding the Net Worth Top 2 Percent offers a clear picture of what it takes to join the financial elite. This benchmark highlights the importance of strategic investments, asset diversification, and long-term financial planning.

Achieving this level requires discipline, smart financial decisions, and consistent wealth-building practices. By studying the habits and strategies of the top 2 percent, anyone can gain insights to grow their personal net worth and secure lasting financial success. Observing these patterns also shows how global wealth distribution works and why financial literacy is crucial.

Frequently Asked Questions

What is the Net Worth Top 2 Percent?

The Net Worth Top 2 Percent represents households or individuals with approximately $8.5 million or more, placing them among the elite wealthiest globally.

How much money do you need to be in the Top 2 Percent?

To enter the top 2 percent, individuals typically require a net worth of at least $8.5 million, including all assets minus liabilities.

Who qualifies for the Top 2 Percent Net Worth?

High-income professionals, entrepreneurs, and investors with diversified assets like stocks, real estate, and business holdings usually qualify.

What assets contribute to the Top 2 Percent Net Worth?

Assets include investment portfolios, real estate equity, retirement accounts, and business ownership, which form the bulk of their wealth.

At what age do people reach the Top 2 Percent Net Worth?

Most individuals reach Top 2 Percent Net Worth between 40–55 years, after decades of career growth, investments, and asset accumulation.

How does the Top 2 Percent manage wealth?

Wealth management strategies like diversification, tax planning, and estate planning are critical for preserving and growing net worth.

Where are most Top 2 Percent households located?

They are concentrated in major financial hubs, including New York, Los Angeles, Toronto, London, and other global cities.

Why is understanding the Top 2 Percent Net Worth important?

It provides benchmarks for wealth accumulation, guides investment strategies, and helps individuals plan for financial security and growth.

Sarah Mitchell is a creative writer and content enthusiast who believes in the timeless power of words. With a passion for literature and expression, she dedicates her work to crafting relatable and meaningful pieces that inspire and connect with readers.

At ShayariStream, Sarah focuses on curating English Shayari, Quotes, Messages, and Status & Meanings that capture emotions and moments in the most authentic way. Her writing reflects everyday feelings—from love and happiness to motivation and reflection—making it easy for people to find words that truly resonate.

Sarah’s mission is to help readers express their thoughts beautifully, whether it’s through a heartfelt message, an inspiring quote, or a simple status update. Her commitment to quality and creativity ensures that every visitor to ShayariStream leaves with words that add meaning to their lives.