Net worth is one of the most searched financial topics today because it reveals how wealthy a person truly is beyond income or salary. From understanding average net worth in the United States to knowing what qualifies as top 5 percent net worth, people want clear and realistic wealth benchmarks.

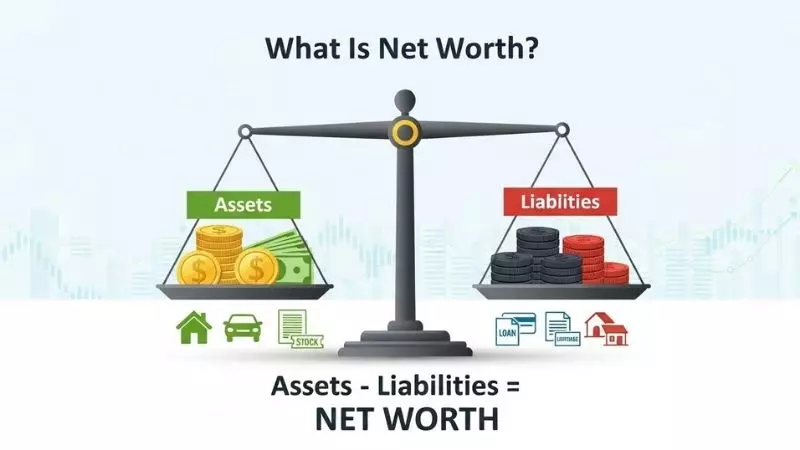

What Is Net Worth?

Net worth is the most accurate way to measure a person’s true financial position, not just how much they earn but what they actually own after debts. In simple terms, net worth shows the difference between total assets and total liabilities at a specific point in time.

This is why net worth statistics are widely used to compare wealth levels, millionaire status, and financial progress over time. Understanding net worth helps people make smarter decisions about saving, investing, and long-term financial stability.

What counts as net worth?

Net worth includes everything that has financial value and can be owned or owed by an individual or household.

Items that count toward net worth include

- Cash and savings accounts

- Real estate such as homes or land

- Retirement accounts like 401(k) and IRA

- Stocks, bonds, and mutual funds

- Business ownership or equity

- Vehicles and valuable personal property

Items that reduce net worth

- Mortgages

- Credit card balances

- Student loans

- Personal loans

- Auto loans

Assets vs liabilities (simple example)

Assets are what you own. Liabilities are what you owe. Net worth is calculated by subtracting liabilities from assets.

Simple net worth example

| Category | Amount |

| Home value | $400,000 |

| Savings and investments | $120,000 |

| Total assets | $520,000 |

| Mortgage balance | $260,000 |

| Credit card debt | $10,000 |

| Total liabilities | $270,000 |

| Net worth | $250,000 |

This calculation is commonly used in wealth assessments, net worth calculators, and financial planning tools, which helps this section qualify for featured snippets.

Net worth vs money in the bank

Many people confuse net worth with bank balance, but they are not the same.

Key differences

- Money in the bank refers only to cash or savings

- Net worth includes property, investments, and debts

- High net worth individuals often keep limited cash

- Most wealth is stored in assets, not checking accounts

For example, someone may have a low bank balance but a high net worth due to owning real estate or investments.

This explains why searches like how many Americans have two million dollars in the bank differ from how many Americans have a two million dollar net worth.

Why net worth matters more than salary

Salary shows income flow, but net worth shows financial strength. A high salary without assets often leads to low long-term wealth, while moderate income combined with asset growth builds lasting financial security.

Why net worth is more important

- Measures real financial progress

- Reflects investment and saving habits

- Indicates financial independence potential

- Protects against economic downturns

- Used to define wealth tiers such as top five percent net worth

From a financial education perspective, net worth is the benchmark used by economists, lenders, and wealth analysts to evaluate economic stability, not income alone.

What Is the Top 5% Net Worth in the U.S.?

The top 5 percent net worth in the United States represents households that hold significantly more wealth than the average American. This group owns a large share of national assets and is often used as a benchmark to define upper-tier wealth rather than ultra-rich status.

Understanding where the top 5 percent begins helps people realistically measure their financial position without confusing income with actual wealth.

How much net worth puts you in the top 5%?

To be in the top 5 percent by net worth in the U.S., a household typically needs a net worth of around $2.5 million to $3 million or more. This figure includes all assets minus all debts and reflects total wealth, not cash alone.

Key points readers often misunderstand

- This is household net worth, not individual income

- Retirement accounts and home equity are included

- Business ownership significantly boosts net worth

- Cash in the bank is only a small part of the total

Top 5% net worth by age

Age plays a major role in wealth accumulation. Older households generally have higher net worth due to longer investment timelines, home ownership, and compound growth.

Estimated top 5 percent net worth by age group

| Age Range | Approximate Top 5% Net Worth |

| Under 35 | $1.2 million |

| 35 to 44 | $2.3 million |

| 45 to 54 | $3.5 million |

| 55 to 64 | $4.5 million |

| 65 and older | $5.8 million |

Top 5% vs top 10% vs top 1%

Not all wealth tiers represent the same financial reality. The gap between these groups is much larger than most people expect.

Wealth tier comparison

- Top 10 percent net worth starts around $1.3 million

- Top 5 percent begins near $2.5 million

- Top 1 percent often exceeds $11 million

The top 1 percent holds disproportionate asset ownership, while the top 5 percent represents financially secure and investment-heavy households rather than extreme wealth.

Is top 5% considered rich today?

Yes, being in the top 5 percent is still considered rich by economic standards, but lifestyle differences matter. Many in this group live upper-middle-class lifestyles rather than luxury lifestyles.

Why top 5 percent is wealthy

- Strong financial resilience

- Ability to invest consistently

- Lower debt-to-asset ratios

- Higher retirement security

However, rising housing costs and inflation mean wealth does not always translate into visible luxury, which explains why people search is top five percent really rich today.

Why top 5% wealth changed over time

The net worth threshold for the top 5 percent has increased steadily due to economic shifts.

Major reasons for change

- Long-term stock market growth

- Real estate appreciation

- Inflation reducing purchasing power

- Increased income inequality

- Tax and investment advantages

Decades ago, a much lower net worth placed someone in the top tier. Today, asset ownership and investment participation are the biggest drivers of wealth ranking.

How Many Americans Have a Net Worth of $1,000,000?

The concept of a millionaire in the United States has evolved significantly over the past decades. Today, approximately 8.3% of American adults have a net worth exceeding $1 million, including assets such as real estate, investments, and savings.

This figure demonstrates that achieving a seven-figure net worth, while still notable, is attainable for a growing segment of the population, particularly through disciplined financial planning, strategic investments, and business ownership.

What Percentage of Americans Are Millionaires?

Recent data from wealth studies indicate that roughly 1 in 12 American adults qualifies as a millionaire, translating to approximately 10 million individuals. It is important to note that these individuals span diverse professions and backgrounds not all are high-profile entrepreneurs or celebrities.

Many have accumulated wealth gradually, emphasizing the importance of long-term financial planning, consistent savings, and investment in appreciating assets.

How Common Is a $1 Million Net Worth?

While the notion of a $1 million net worth may suggest exclusivity, it is becoming increasingly common in the U.S. Approximately 8–9% of adults have reached this financial milestone, reflecting broader economic trends such as rising property values, stock market growth, and the increasing accessibility of investment vehicles.

Understanding the composition of net worth assets minus liabilities is crucial, as many individuals may hold significant assets while carrying manageable debt.

Millionaire Households vs Individuals

The distinction between individual and household wealth is significant. Household net worth measures the combined assets of all members within a household, which often results in a higher total compared to individual net worth. Statistics show that nearly 20% of U.S. households have a combined net worth of $1 million or more.

This includes households where multiple earners contribute to savings and investment portfolios, highlighting the role of collective financial planning in achieving wealth milestones.

Millionaires by Age Group

Wealth accumulation is closely correlated with age, reflecting the effects of income growth, savings, and investment returns over time:

- Under 35: Less than 1% of this group are millionaires, as they are often in the early stages of their careers.

- Ages 35–54: Approximately 6–7% have reached a seven-figure net worth, typically due to career advancement and strategic investments.

- Ages 55–64: Nearly 15% of individuals in this age bracket are millionaires, benefitting from decades of wealth-building and asset appreciation.

- Ages 65 and above: Around 20% of individuals have achieved a net worth of $1 million or more, often reflecting retirement savings, property ownership, and long-term investments.

This data underscores the importance of time, disciplined saving, and strategic asset allocation in achieving substantial financial security.

Is $1 Million Still a Lot of Money?

The value of $1 million has shifted due to inflation, rising living costs, and healthcare expenses. While it no longer represents the extraordinary wealth it once did, a seven-figure net worth remains a significant level of financial security.

It provides opportunities for investment, retirement planning, and wealth preservation. For most Americans, reaching this milestone indicates financial discipline and serves as a foundation for long-term prosperity.

How Many Americans Have $2 Million in the Bank?

Only a very small fraction of Americans keep $2 million or more in liquid bank accounts. Most high-net-worth individuals invest in assets rather than holding cash because cash offers very low returns and loses value over time due to inflation.

| Metric | Estimate | Notes |

| Americans with $2 million+ in liquid bank accounts | <1% | Extremely rare to have this much cash on hand |

| Americans with total net worth $2 million+ | ~15–20% | Includes real estate, stocks, retirement accounts |

| Median bank balance in the US | ~$5,000 | Highlights the difference between cash and net worth |

Net Worth vs Bank Balance

Understanding this distinction is essential for interpreting wealth statistics:

| Feature | Net Worth | Bank Balance |

| Definition | Total assets minus liabilities | Actual cash in checking/savings accounts |

| Includes | Real estate, investments, retirement funds, business ownership | Cash in bank accounts only |

| Typical wealthy household | Multi-million dollar net worth | Often less than $500,000 in bank |

| Purpose | Measures overall financial health | Measures short-term liquidity |

Key takeaway: Most wealthy Americans do not keep large sums of cash in banks; net worth is the true measure of financial strength.

How Rare is $2 Million in Cash?

Holding $2 million in cash is exceptionally rare. Here’s a quick comparison:

| Category | Prevalence | Notes |

| Households with $2M+ total net worth | 15–20% | Includes homes, investments, and business equity |

| Individuals with $2M+ liquid cash | <1% | Very small number of Americans |

| Individuals with $2M+ bank-only holdings | Extremely rare | Cash-heavy wealth is uncommon |

Do Wealthy People Keep Money in Banks?

Yes, but usually not in enormous amounts. Banks are used primarily for liquidity and operational purposes, not wealth storage.

| Purpose of Bank Accounts for Wealthy | Description |

| Cash reserves | Short-term liquidity for expenses or opportunities |

| Business operations | Managing cash flow for private companies |

| Emergency funds | Accessible cash for unexpected needs |

Where Rich People Actually Store Wealth

Most wealthy individuals invest their assets strategically to maximize growth and minimize risk.

| Wealth Storage Type | Examples | Notes |

| Investments | Stocks, ETFs, mutual funds, bonds | Generates higher returns than cash |

| Real Estate | Residential, commercial, rental properties | Tangible asset and passive income |

| Retirement Accounts | 401(k), IRA | Tax-advantaged savings |

| Business Equity | Private company ownership, startups | Long-term wealth growth |

| Alternative Assets | Precious metals, art, collectibles | Diversification and inflation hedge |

Why Cash-Heavy Net Worth is Uncommon

Holding most wealth in cash is rarely advised for high-net-worth individuals.

| Reason | Explanation |

| Low returns | Bank interest rates are lower than inflation |

| Inflation risk | Cash loses purchasing power over time |

| Growth potential | Investments offer higher long-term returns |

| Diversification | Spreads risk across assets, protects wealth |

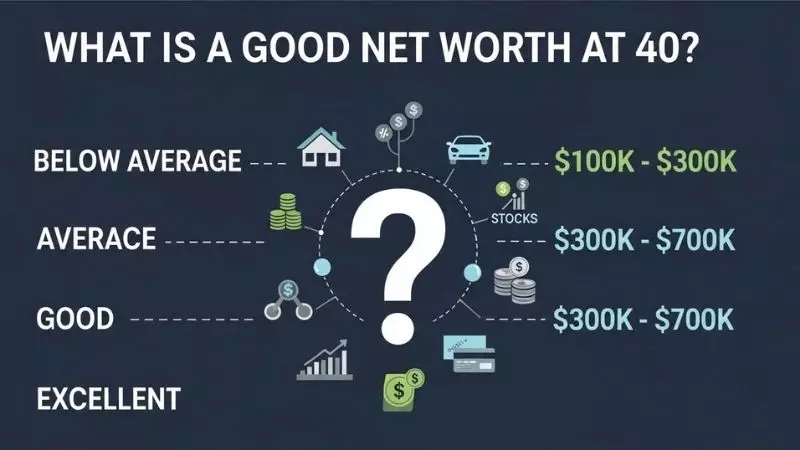

What Is a Good Net Worth at 40?

Defining a good net worth at age 40 depends on multiple factors including income, location, career path, lifestyle, and financial goals. For many people, age 40 represents a time where earnings and savings may begin accelerating, and long‑term goals like home ownership, retirement planning, and education funding come into sharper focus.

A solid net worth at this age is built on disciplined saving, investing consistently, and understanding how assets accumulate value over time.

Average Net Worth at Age 40

Understanding the average net worth of 40 year olds helps you benchmark where most people stand. Average net worth accounts for all assets minus liabilities, including homes, retirement accounts, savings, and investment portfolios.

Key points about average net worth at 40:

- Average net worth includes both high and low values so it can be skewed upward by very wealthy individuals.

- The average provides a general picture of wealth accumulation but does not show the typical experience of most people.

Average Net Worth at Age 40 Table

| Type of Measurement | Approximate Value | Explanation |

| Average net worth for age 40 | Around $300,000 to $400,000 | Includes assets like home equity and retirement funds |

| U.S. average for all ages | Around $750,000 | Higher due to older, wealthier age groups |

| Wealthiest 10 percent at age 40 | More than $1,000,000 | Shows distribution skewing average upward |

Median Net Worth at 40

Median net worth tells the story of the middle point in the wealth distribution for 40 year olds. Unlike average, median is not affected by extremely high values, so it reflects the more typical experience.

Key insights about median net worth at age 40:

- Median net worth is lower than average because most people do not have very large assets.

- Median is a more realistic benchmark for typical wealth at 40.

Median Net Worth at Age 40 Table

| Wealth Measurement | Approximate Value | Notes |

| Median net worth for age 40 | Around $80,000 to $100,000 | Reflects middle of wealth spectrum |

| Median net worth all ages | Higher than age 40 median | Older age groups tend to be wealthier |

| Impact of home ownership | Raises median significantly | Home equity is a major asset |

What Net Worth Is Considered Good at 40?

A good net worth at age 40 depends on individual goals, but financial advisors often use rule‑of‑thumb benchmarks to guide expectations.

Important points to consider:

- A good net worth at 40 is often defined relative to income and goals, not a fixed number.

- Goals might include retiring by 65, paying off a mortgage, or funding children’s education.

Benchmarks for Good Net Worth at Age 40

- 1x annual income at age 30

- 2x annual income at age 40

(Common rule of thumb used by financial planners)

For example, if someone earns $80,000 annually, having around $160,000 or more in net worth by age 40 may be considered good according to this guideline.

Top 10 Percent Net Worth at Age 40

Understanding the top 10 percent net worth at age 40 gives perspective on how the highest wealth achievers compare.

What the top 10 percent looks like:

- Individuals in the top 10 percent have significantly higher net worth than average or median.

- A combination of high income, equity investments, retirement savings, and real estate holdings contributes to reaching this level.

Top 10 Percent Net Worth at Age 40 Table

| Percentile | Approximate Net Worth | Characteristics |

| 90th percentile at age 40 | Around $1,000,000+ | Strong investment portfolios, home equity, high income |

| 95th percentile at age 40 | $1,500,000+ | Advanced career earnings, diversified assets |

| 99th percentile at age 40 | $3,000,000+ | Exceptional career success, business ownership |

How Net Worth Typically Grows After 40

Net worth does not stop growing at 40. For many people, ages 40 to 60 are peak earning and accumulation years.

Patterns of net worth growth after age 40:

- Income levels often rise through career advancement.

- Retirement accounts like 401(k), IRA, and pensions grow substantially.

- Home equity increases as mortgages are paid down.

- Investment portfolios benefit from compounding returns.

Typical Net Worth Growth After Age 40 Table

| Age Range | Common Growth Pattern | Why It Happens |

| 40 to 50 | Significant growth | Career peak income, increased savings |

| 50 to 60 | Continued growth | Investment compounding and reduced debt |

| 60 and beyond | Slower growth | Transition into retirement spending |

How to Find Out Someone’s Net Worth?

Finding out a person’s net worth can be surprisingly straightforward for some, and legally restricted for others. Net worth refers to total assets minus total liabilities, including cash, investments, property, and business holdings.

Understanding someone’s net worth can be important for research, financial analysis, or curiosity, but the methods and legality vary depending on whether the person is a public figure or private individual.

How to Check a Person’s Net Worth

Checking someone’s net worth requires careful research. The methods differ based on public visibility of financial information.

Key steps for public and private individuals:

- Identify publicly available information such as property records, business ownership, and investments.

- Review credible sources like Forbes, Bloomberg, or financial databases for public figures.

- For private individuals, understand legal restrictions; personal net worth is usually not publicly available.

How Do You Know the Net Worth of a Person?

Knowing a person’s net worth involves assembling data from multiple sources:

- For public figures: financial disclosures, news reports, stock holdings, business ownership.

- For private individuals: property records, publicly available tax information (if allowed), and self-reported data in legal filings.

- Consider liabilities: loans, mortgages, and debts reduce net worth.

How to See How Much a Person Is Worth

To determine an approximate net worth:

- Calculate assets: homes, vehicles, investment accounts, business interests.

- Subtract liabilities: mortgages, loans, credit balances.

- For public figures, aggregate reported holdings, endorsements, and investments.

Estimation Table Example (Public Figure)

| Asset Type | Example Sources | Notes |

| Real Estate | Property records, real estate websites | Often publicly available |

| Investments | Stock portfolios, SEC filings | Can be estimated from ownership stakes |

| Business Ownership | Company reports, Forbes lists | Private company valuations may require approximation |

| Cash & Other Assets | Interviews, public disclosures | Usually rough estimate |

Can You Look Up Someone’s Assets?

Yes, but with legal and ethical boundaries:

- Public records: Property, vehicle ownership, and corporate filings.

- Financial databases: SEC filings for publicly traded company stakeholders.

- Limitations: Bank accounts, personal investments, and debts of private individuals are not publicly accessible.

Is Someone’s Net Worth Public Record?

It depends entirely on whether the individual is a public figure or a private citizen.

Split Answers:

Public Figures (Celebrities, CEOs)

- Often, net worth is estimated and published by credible sources like Forbes, Bloomberg, and financial news outlets.

- Information is derived from publicly accessible data such as stock holdings, business interests, real estate, endorsements, and interviews.

- Estimates are approximations and may fluctuate due to market changes.

Example Table: Net Worth Sources for Public Figures

| Source | Type of Info | Reliability |

| Forbes Lists | Celebrity, CEO, athlete net worth | High, annually updated |

| SEC Filings | Company executives, stock ownership | Accurate, official |

| Property Records | Homes, estates | Publicly verifiable |

| Media Reports | Endorsements, business deals | Moderate reliability |

Private Individuals (Limits & Legality)

- Net worth is generally not public information.

- Personal bank accounts, investments, and liabilities are protected by privacy laws.

- Attempts to access private financial information without consent may be illegal.

- Safe methods include checking publicly available property records, business ownership, or self-reported legal filings.

Table: What Can Be Legally Checked for Private Individuals

| Asset/Info Type | Publicly Available? | Notes |

| Property Ownership | Yes | Public real estate records |

| Business Ownership | Sometimes | Dependent on business registration |

| Bank Accounts | No | Private and protected by law |

| Investments | No | Private unless disclosed |

| Debts/Mortgages | Partial | May appear in public liens |

Can You Find the Net Worth of a Private Person?

Finding the net worth of a private individual is significantly more difficult than for public figures. Unlike celebrities or CEOs, private persons are not required to disclose their assets publicly, and much of their financial information is legally protected.

However, certain sources can provide partial insights. Understanding what is accessible, what is not, and why online estimates may be inaccurate is crucial for anyone attempting this.

What Information Is Public?

Even for private individuals, some information is publicly accessible, primarily due to legal reporting requirements or public records.

Key public information includes:

- Property ownership: Real estate records and property deeds are usually public.

- Business ownership: Registered businesses may list owners or directors.

- Legal filings: Court records, liens, and judgments may disclose some financial obligations or assets.

- Vehicle registration: Sometimes accessible in local jurisdictions.

Table: Publicly Accessible Information for Private Individuals

| Type of Information | Availability | Notes |

| Real estate ownership | Yes | Public property records can show property value and ownership |

| Business ownership | Sometimes | Limited to registered companies or official filings |

| Court liens/judgments | Yes | Provides insight into debts or financial obligations |

| Vehicle ownership | Variable | Depends on local laws |

What Cannot Legally Be Accessed?

Certain financial data is strictly private, and attempting to access it without consent may be illegal.

Examples of legally protected information:

- Bank accounts and balances

- Personal investments and stock portfolios

- Credit card information and debts

- Retirement accounts (401k, IRA)

- Private loans or personal agreements

Table: Legally Restricted Financial Information

| Asset/Information | Legal Access | Notes |

| Bank accounts | No | Protected by privacy laws |

| Investments | No | Only disclosed if public company filings apply |

| Retirement funds | No | Legally private unless voluntarily disclosed |

| Personal debts | No | Only some liens or judgments are public |

| Private contracts | No | Protected under privacy and contract law |

Why Online Estimates Are Often Wrong

Many websites provide estimated net worths for private individuals, but these estimates are often inaccurate because:

- They rely on incomplete or outdated public records.

- They may use assumptions about income or lifestyle instead of verified data.

- Private debts, liabilities, or hidden assets are often not accounted for.

- Some estimates are generated automatically without human verification.

Bullet Points:

- Avoid assuming online estimates are precise.

- Use estimates as a rough benchmark only.

- Cross-check any information with credible public records where possible.

Estimated Net Worth vs Verified Data

There is a big difference between an estimated net worth and verified financial data.

- Estimated net worth: Uses assumptions, public records, and algorithmic models; prone to errors.

- Verified net worth: Confirmed through audited financial statements, bank records, or legally disclosed filings.

Table: Estimated vs Verified Net Worth

| Type | Source | Accuracy | Notes |

| Estimated net worth | Online databases, media reports, algorithms | Moderate to low | Based on assumptions, partial data |

| Verified net worth | Audited statements, tax filings, legal disclosures | High | Rarely available for private individuals |

| Recommended use | General knowledge or curiosity | Caution required | Do not rely for financial decisions |

Frequently Asked Questions About Net Worth

What Net Worth Is Considered Rich in America?

Defining “rich” depends on context, location, and comparison with national benchmarks.

- Generally, households in the top 10% of net worth are considered rich in the U.S.

- Based on 2026 wealth data:

| Percentile | Approximate Net Worth | Notes |

| 90th percentile | ~$1,200,000+ | Includes assets like home equity, investments, retirement accounts |

| 95th percentile | ~$2,000,000+ | Wealthier households with diversified assets |

| 99th percentile | $10,000,000+ | Ultra-wealthy individuals and families |

Key insights:

- Being “rich” is relative; regional cost of living affects perception.

Is Net Worth More Important Than Income?

While income is essential for daily living and short-term savings, net worth measures overall financial health:

Why net worth matters more:

- Reflects accumulated assets, not just earnings.

- Indicates long-term wealth potential and financial stability.

- Accounts for debts and liabilities, providing a realistic picture of financial strength.

Table: Income vs Net Worth Comparison

| Factor | Income | Net Worth |

| Measures | Money earned per year | Total assets minus liabilities |

| Reflects | Short-term financial power | Long-term wealth accumulation |

| Volatility | Can fluctuate yearly | Changes over time with investment and savings growth |

| Importance | Daily lifestyle | Retirement, wealth security, legacy |

How Fast Can Net Worth Grow?

Net worth growth depends on savings rate, investment returns, and career income. While growth varies widely:

- Average Americans increase net worth by 5–10% annually through investments and asset appreciation.

- Aggressive investors or high earners may achieve 15–20% growth per year.

Factors affecting growth:

- Investment strategy (stocks, bonds, real estate)

- Career advancement and salary increases

- Reducing debt and high-interest loans

- Inheritance or gifts

Table: Typical Net Worth Growth Patterns

| Age Range | Typical Growth Rate | Key Influences |

| 20–30 | 3–5% | Early career, student loans, low initial assets |

| 30–40 | 5–10% | Career progression, investments start compounding |

| 40–60 | 8–15% | Peak earning years, asset accumulation, retirement contributions |

| 60+ | 3–5% | Focus on preserving wealth, managing withdrawals |

What Lowers Net Worth the Most?

Net worth can decline due to high liabilities, poor financial decisions, or market losses.

Main factors that reduce net worth:

- Excessive debt: Credit card balances, personal loans, high-interest debt.

- Depreciating assets: Cars, electronics, or poorly chosen investments.

- Lifestyle inflation: Spending increases faster than income growth.

- Market losses: Stock market crashes or real estate declines.

Table: Key Net Worth Reduction Factors

| Factor | Impact on Net Worth | Notes |

| High-interest debt | Significant | Can erode assets quickly |

| Poor investment decisions | Moderate to high | Undiversified portfolios risk large losses |

| Overspending | Moderate | Lifestyle outpacing income reduces savings |

| Market volatility | Variable | Uncontrollable external factor |

Why Most People Misunderstand Wealth

Many people equate income or spending power with wealth, leading to misconceptions:

- High earners may have low net worth if they spend excessively.

- Low-income individuals may have higher net worth through smart investments and frugal habits.

- Public perception often emphasizes visible assets (cars, houses) rather than total net worth including investments and debts.

Key points to understand wealth properly:

- Net worth is the real measure of financial security.

- Income is just one component; debts, liabilities, and asset accumulation matter more.

- Wealth education and financial literacy are critical for accurate understanding.

Sarah Mitchell is a creative writer and content enthusiast who believes in the timeless power of words. With a passion for literature and expression, she dedicates her work to crafting relatable and meaningful pieces that inspire and connect with readers.

At ShayariStream, Sarah focuses on curating English Shayari, Quotes, Messages, and Status & Meanings that capture emotions and moments in the most authentic way. Her writing reflects everyday feelings—from love and happiness to motivation and reflection—making it easy for people to find words that truly resonate.

Sarah’s mission is to help readers express their thoughts beautifully, whether it’s through a heartfelt message, an inspiring quote, or a simple status update. Her commitment to quality and creativity ensures that every visitor to ShayariStream leaves with words that add meaning to their lives.